The Property Cycle

So, where does the problem lie?

As we can see that given two completely different Regions and factoring in the North – South divide, that there are opportunities to capitalize irrespective of how wide and varied each of the property markets may be.

People who over borrowed, leveraged against their property and purchased properties during the peak of the market where the worst hit.

There were certain investors who purchased properties with a view to buying them and then almost immediately looking to sell them for a quick profit looking to take advantage of an appreciating market.

Like any business strategy, any such short term view will always represent a higher level of risk as any volatility or change in market forces may not be factored in or be able to be accounted for and as such leaving a speculative investor exposed.

For example someone purchasing a Property in the North West as at December 2007 would have paid £135, 869 [an average property price for the North West according to Land Registry data for that period]. In January 2013 the average price for a property in the North West had dropped to £106,435, a loss of- £29,429.

Like any market, purchasing a property, a commodity or stock at its peak, represents a a high risk strategy as you are unable to have a margin for error, and as such will effect your capital value should such stock devalue. However, as property is an income generating asset, such dips in the market can be held off provided there is a sit and hold strategy in place, something that potentially cannot be done with certain not dividend providing stocks and shares.

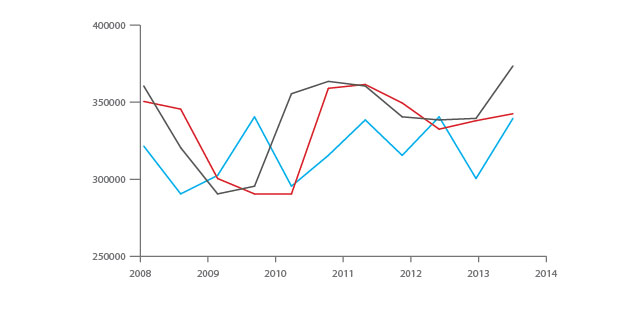

London 2008-2013

In this example if the property was purchased in January 2008 and was to held for 16 months then there would have been a loss. But by holding the property for a further period of 28 Months the value of the property value had actually increased. We must also include in to this over this period, there would have been an increase in rental income, lower base rates all of which would mean an increase in cash flow.

So who lost?

- Those who purchased property whilst it was at its peak and unable to manage their properties unable to manage their finances and or rental portfolios

- Those who had over spent and had other toxic liabilities

- Those who may have lost their employment and or businesses

- Those who did not have a correct plan and strategy

We cannot account for personal circumstances such as health, or other specific mitigating circumstances as these are very specific to each individual. The above provides a general overview.

So why do some succeed more than others?

Success is all in the strategy, having the right plan, means you will have the ability to consider eventualities and risk profile your business model accordingly. You will always address capital value and income and make provisions for growth and a decline in the market.

Purchasing a property whilst the property is at its peak will always represent an increased risk to any strategy. Purchasing a property whilst the market is in recession or is coming out of a recession, is always a great time to purchase as the market has corrected itself and as such the value has been set at a low point as opposed to its optimum.

It is common knowledge that when purchasing property, stock or shares at a low point will always stand you in good stead, as long as there is demand and provided of course it’s an established commodity with mass appeal, and then the risk for such an acquisition can be greatly reduced.

Investors, who had identified the potential in the market in the last recession, learnt of the previous downturn in the 1970’s. Taking advantage of a fallen market in the early 1990’s they began to acquire properties and work on a strategic plan, of acquiring and attracting double digit yields. This allowed them to break even faster and to recapitalize, and as time progressed they had established portfolios of properties, with low gearing ratios – highly income generating assets.

So, by the time the recent property boom came to light and the general market reacted, the more savvy investors who had already acquired properties where not exposed to such risks. They already had the capital and income, but more importantly a strong liquidity position. As the market rose in value, their assets increased in value, and as they knew how the markets worked, they sold and traded negative stocks with better propositions, all of which added to them increasing their equity gains and further enhancing income.

As the market crashed, and the world looked upon property in a negative light, those same investors knew that this was inevitable and a cyclical eventuality, something that they had already anticipated. Armed with knowledge as the market turned, the more experienced investors started their acquisition trails again repeating the cycle, creating further wealth.

Should I wait to Buy or should I look right away?

Well this is a very personal question, and will solely depend upon an individual’s personal financial circumstances, their goals and objectives, their determination and belief, and more importantly their ability to manage and make decisions.

The Property Investment Market moves at a frantic pace, and despite the doom and gloom merchants and the negative sentiments by media or financial analysts, established investors, institutional investors, and new comers who have realized the benefits of acting on the market are frantically purchasing and acquiring properties.

What makes the investment even more appealable is that purchasing a property through Properties Discounted ™ you will be purchasing a property at a real discount. Purchasing a property at 20% discount off today’s value means that you have automatically made an instant equity gain of 20%.

To put this in context, you are purchasing stock at 20% minimum off today’s value, knowing full well, that such stock will rise in value, and provide you with an income enabling you to add another cash flow income stream to your household income. As time progresses and demand for property increases, the market will react and as such more investors and home owners will look to purchase all of which will help drive prices higher. By delaying investing, you are reducing your opportunity of today’s market and if you are genuinely in a position to invest, then the best time to avail an opportunity is now, as the discounts you will expected to receive today may not be available when consumer confidence is at its peak as price for the same stock will inevitably increase.

Why is this Market so Great.

It’s a great time to negotiate a deal with a Seller of a property. At properties discounted we have cut out all the middle men and as such you will be dealing directly with the point of source which us, saving you time, energy and money in searching for properties aimlessly with companies that are never in actual control.

Imagine going to your bank manager, and saying that you would like to deposit your saving with them for a period of 1 year, and let’s use £50,000 as an example. You will probably be looking at receiving a return of may be 1to 3% on the money you deposit with them. At the end of the year, you will receive back £53,000 [provided you got an excellent deal at 3%). That’s a profit of £3,000. The question you may consider is what the bank is doing with your £50,000 in order for them to give you a return of 3%. Banks are a business, and as such they are investing your money, making a profit in order to provide you with a small return.

Instead of going to the Bank, if you purchased a property for £50,000 and you managed to buy it 20% cheaper through Properties Discounted™. The property rented out at £400 per month [of course you would have running costs, and say these equated to £100 per month), that would provide you with a Net profit of £300) per month. At the end of the year, if you sold the property for full market value and there was no capital appreciation, then your closing balance would be £62,500 (as you bought the property 20% cheaper) plus (rental income £3,600), less purchase and sale costs (approximately £4,000 to include legal fees, surveyors, searches, agents, etc.), which will equal = £62,100.

Now if we were to compare and contrast the two examples, you will see that the difference would be £9,100 (£62,100 less £53,000). You would be an additional £9,100 better off, that’s a difference of 18.2% over a one year period. If you became creative and increased the rental by doing room lets you could further enhance your return.

The market represents an excellent opportunity as it allows you to negotiate a better deal and as such benefit from equity gains based on today’s value, providing you with an income which greatly outweighs many other investment classes, such as deposit money with bank in fixed saving account.

With the UK being one of the strongest financial economies in the world, together with being one of the if not the largest financial centers, together with key government polices aiming to rejuvenate and kick start the housing market and finatial markets, the question is not if we will recover but more so of when.

This in mind, purchasing a property in today’s market represent excellent value, purcashing a property at a low value today, should increase in value over a period of time and provide excellent returns through rental income.

If we use the Land registry information and consider purchasing a property in say a static market to a rising market over a period over the next 10 years then we could see a further growth of 401%.

Those investors, who became extremely wealthy, were not necessarily those that were acquiring properties in the boom period, but those who had acquired properties beforehand, and they capitalized in the boom years. The downturn in the market could have been over ridden by them had their leveraging ratios were not affected.

So, is it the best time to buy now, then the answer has to be YES, again dependentupon your personal circumstances and you’re investment strategy.

So when is it a good time to buy?

NOW

So, what should I buy and where should I Buy?

It is imperative before you set out to what you’re looking to purchase, to define your own strategy and understand your own model, once you have done this, then you will be able to look at the best investment strategy that fits in with your business model. This way you can work the business and not allow the property to work you. Points you should consider are, your;

- Personal circumstances such as employment, financial liabilities current and pending

- Your current cash flow

- Your own reasons as to why you’re looking to invest, so it’s vital you assess your personal and financial goals and objectives.

- Your own personal investment strategy, what you personally expect and what you constitute success is to you as an individual

- The amount of savings you have available and your ability to gain finance

In fact there are numerous reasons as to the reason you’re looking to invest. Although we may not be able to guide you in respect of your finantial and tax planning, we can help provide you with the information necessary in order for you to ascertain what strategy and investment property will fit your requirements.

We are highly experienced at Properties Disocunted™ in property investment, no client is too big or too small, everyone is treated the same. We are always available to help assist, and if need be you can arrange to have a free consultation with an experienced property investment consultant to help provide you with further information to help you with your strategy.

Why should I believe the UK economy will recover?

Well, let’s turn back the clocks; purchasing a property in the last recession, where unemployment was high, finance rates went up to 15%, lending was again extremely difficult obtain, the market still recovered and as such we just witness a property boom. We can tell from historic data that markets that go in to recession do recover over a period of time.

We understandable the characteristics of this recession are different to previous downturns; however the basic fundamentals of a depressed economy are the same, such as high inflation, low unemployment and low GDP.

Each of the world’s major economies have vested interests in each other’s economies, be that through trade or intertwined investment structures, any one of them failing will mean a knock on effect to them all and as such failing is not an option for them, all the more reason that these countries will work together, readapt, reapply and continue towards stablising and growing their economies as soon as is possible.

We know through media, data and facts that the rental market is on the increase, housing numbers are low comparative to supply and as such rents have dramatically increasedthrough the recession.

We know current house prices are historically low in value due to the current economic climate and as such purchasing property currently will be done so at a low point.

We know that land is scarce, and that it is cheaper to buy a property in the current market, then to potential purchase land and construct.

More are more lenders are returning to the market with many more products and rates on offer comparative to when the financial markets crashed during this recession, all of which demonstrates that a positive sentiment is returning back to the markets.

House price statistics are showing increased activity in the market.

The UK Housing market is valued at approximately £4 trillion, it’s too big to fail.

With other economies not as strong and adept as the UK economy it is still seen as a safe haven by many and as such there is a large influx of investment from overseas investors.

The Base Rate has been at its lowest point for the longest duration at 0.5% since the base rate was ever recorded.

The Uk population is currently at 63.2 million according to 2011 census. The Population is set to rise to almost 72 million by 2031 as suggested by the ONS [official National Statistics] that’s a rise of approximately 450,000 people a year.

There is a huge shortage of housing in the Uk Market. The number of households is predicted to increase by 232,000 a year, every year until 2033. The current rate of construction of new homes is approximately at 100,000 a year, a shortage of 132,000 homes a year.

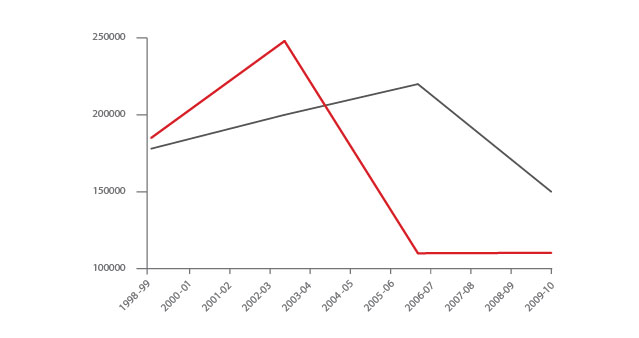

Housing Builds in UK

In 2007 the Government set a target of 240,000 new homes per annum, due to the credit crunch this target has fallen way short, and as such the housing targets have fallen back even further.